Optoelectronics, sensors/actuators, and discretes growth accelerates

Following two lethargic years of low growth and some setbacks, worldwide sales of optoelectronics, sensors, actuators, and discrete semiconductors regained strength in 2014 and collectively increased 9 percent to reach an all-time high of $63.8 billion after rising just 1 percent in 2012 and 2013, according to IC Insights’ new 2015 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. Modest gains in the global economy, steady increases in electronic systems production, and higher unit demand in 2014 drove a strong recovery in discretes along with substantial improvements in sensors/actuators and greater growth in optoelectronics, says the new 360-page annual report, which becomes available in March 2015.

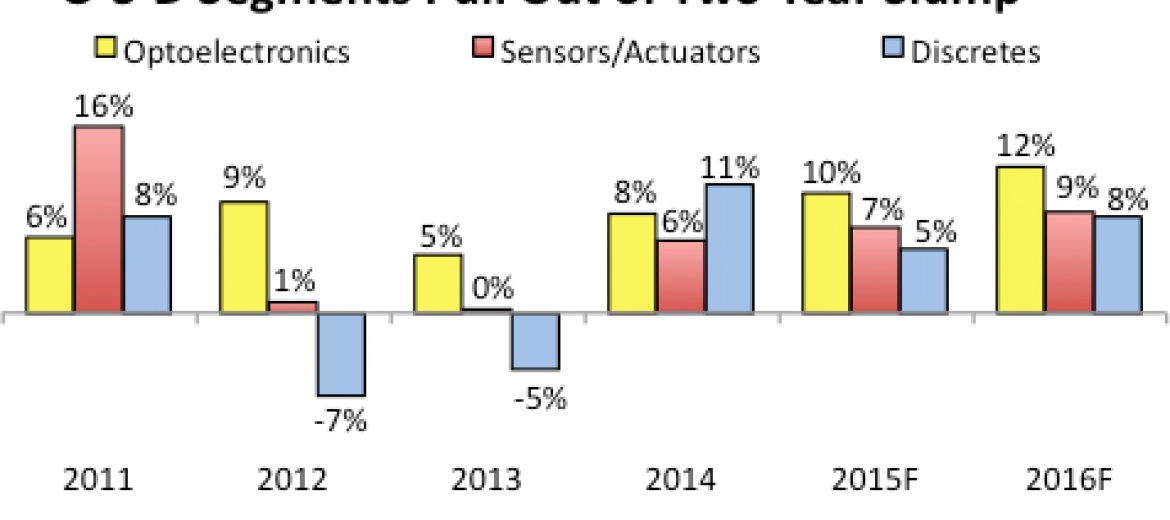

Each of the three O-S-D market segments are forecast to increase at or above their long-term annual growth rates in 2015 and 2016 (Figure 1) as the global economy continues to gradually improve and major new end-use systems applications boost sales in some of the largest product categories of optoelectronics, sensors/actuators, and discretes. After a modest slowdown in 2017, due to the next anticipated economic downturn, all three O-S-D market segments are expected to continue reaching record-high sales in 2018 and 2019, based on the five-year forecast in the new 10th edition of IC Insights’ O-S-D Report.

Optoelectronics sales are now forecast to rise 10 percent in 2015 to set a new record-high $34.8 billion after growing 8 percent in 2014 to reach the current annual peak of $31.6 billion. Sales of sensors/actuators are also expected to strengthen slightly in 2015, rising 7 percent to $9.9 billion, which will break the current record high of $9.2 billion set in 2014 when this market segment grew 6 percent. The commodity-filled discretes market is forecast to see a more normal 5 percent increase in 2015 and reach a new record high of $24.2 billion after roaring back in 2014 with a strong 11 percent increase following declines of 7 percent in 2012 and 5 percent in 2013. The two-year drop was the first back-to-back decline for discretes sales in more than 30 years and primarily resulted from delays in purchases of power transistors and other devices as cautious systems manufacturers kept their inventories low in the midst of uncertainty about the weak global economy and end-user demand.

In 2014, combined sales of O-S-D accounted for 18 percent of the semiconductor industry’s $354.9 billion in total revenues compared to 16 percent in 2004 and 13 percent in 1994. (Optoelectronics was 9 percent of the 2014 sales total with sensors/actuators being 3 percent, discretes at 6 percent and ICs accounting for 82 percent, or $290.8 billion, last year). On the strength of optoelectronics and sensor products—including CMOS image sensors, high-brightness light-emitting diodes (LEDs), and devices built with microelectromechanical systems (MEMS) technology—total O-S-D sales have outpaced the compound annual growth rate (CAGR) of ICs since the late 1990s. IC Insights’ new report shows this trend continuing between 2014 and 2019 with combined O-S-D sales projected to grow by a CAGR of 6.9 percent versus 5.5 percent for ICs.

The 2015 O-S-D Report shows strong optoelectronics growth being driven in the next five years by new embedded cameras and image-recognition systems made with CMOS imaging devices as well as the spread of LED-based solid-state lights and high-speed fiber optic networks built with laser transmitters that are needed to keep up with tremendous increases in Internet traffic, video transmissions, and cloud-computing services, including those connected to the huge potential of the Internet of Things (IoT). The sensors/actuators market is forecast to see steady growth from high unit demand driven by the spread of automated embedded-control functions, new sensing networks, wearable systems, and measurement capabilities being connected to IoT in the second half of this decade. Discretes sales are expected to climb higher primarily due to strong growth in power transistors and other devices used in battery-operated electronics and to make all types of systems more energy efficient—including automobiles, high-density servers in Internet data centers, industrial equipment, and home appliances.

- John Doe

- John Doe